Understanding Property Ownership Before Marriage: Key Considerations

Property ownership is a significant aspect of personal finance and asset management, especially regarding marriage. Understanding how property owned before marriage is treated can profoundly impact marital assets and legal proceedings. This article explores the intricacies of property ownership before marriage, the potential implications during a marriage, and the steps one can take to protect individual property rights.

What is Pre-Marital Property?

Pre-marital property, also known as separate property, refers to any asset that one spouse owned before getting married. This includes real estate, personal belongings, investments, and any other assets acquired individually. The primary distinction is that these assets were not obtained during the marriage and are thus considered the sole property of the individual who owned them prior to the marriage.

Legal Considerations for Pre-Marital Property

-

Ownership Rights: Generally, pre-marital property remains the separate property of the original owner. However, complexities can arise if the property appreciates in value during the marriage or if both spouses contribute to its maintenance or improvement.

-

Commingling of Assets: If the separate property is mixed with marital property, such as combining funds in a joint bank account or using marital income to pay for property expenses, it may become commingled. This can make it difficult to distinguish the property as separate, potentially subjecting it to division upon divorce.

-

Prenuptial Agreements: A prenuptial agreement is a legal document signed before marriage that outlines the ownership and division of assets, including pre-marital property, in the event of a divorce. This agreement can provide clarity and protection for both parties.

-

State Laws: Property division laws vary by state. In community property states, assets acquired during the marriage are typically considered joint property, while the original owner retains separate property. In equitable distribution states, courts divide marital property fairly but not necessarily equally, taking into account the nature of the property and the contributions of each spouse.

Impact on Marital Assets

-

Appreciation and Income: Any increase in the value of pre-marital property during the marriage, as well as any income generated from it, can be a point of contention. Courts may consider the appreciation as marital property, especially if both spouses contributed to the property’s maintenance or improvement.

-

Joint Contributions: When both spouses contribute to the upkeep or enhancement of a pre-marital property, it can blur the lines of ownership. Documenting these contributions and maintaining clear records can help in determining the property’s status in the event of a divorce.

Protecting Pre-Marital Property

-

Keep Property Separate: Avoid commingling pre-marital property with marital assets. Maintain separate accounts and records to distinguish between the two types of property.

-

Prenuptial Agreements: Consider drafting a prenuptial agreement that clearly defines the ownership and division of pre-marital property. This can prevent disputes and protect individual rights.

-

Postnuptial Agreements: Similar to prenuptial agreements, postnuptial agreements are signed after marriage and can address the division of assets, including pre-marital property, in case of a divorce.

-

Regular Documentation: Keep detailed records of any improvements or contributions made to the pre-marital property during the marriage. This documentation can be crucial in maintaining its status as a separate property.

Conclusion

Understanding the nuances of property ownership before marriage is essential for protecting individual assets and navigating the complexities of marital property. Individuals can safeguard their pre-marital assets and ensure a clear distinction between separate and marital property by keeping property separate, considering prenuptial agreements, and maintaining thorough documentation. These steps can provide peace of mind and financial security, whether you’re newly married or planning to tie the knot.

Why You Should Sell Your Deals with Us

Let’s keep it real—wholesaling ain’t easy. You lock up a deal, hustle to find a buyer, get ghosted five times, and by the time someone’s ready, the seller’s threatening to [...]

For Sale: 12914 Buckhorn Dr, Hudson, FL 34669

12914 Buckhorn Dr, Hudson, FL 34669 • Single Family • 3 Beds / 2 Baths • 1,542 sq ft living area [...]

Landlords, Listen Up: Florida’s A+ Economy Is Coming—Here’s Why 2025 Still Makes Sense

Florida’s A+ Economy in 2026: What This Means for Landlords, Renters, and Real Investors Like Me By Jorge Vazquez, CEO of Graystone Investment Group In my 20 years of experience in real estate investing, [...]

What It Really Takes for Agents to Make Millions in Real Estate

What It Really Takes for Agents to Make Millions in Real Estate Inspired by a Fellow Featured Agent—Kat Palmiotti Something special happened recently—both Kat Palmiotti and I had our articles featured on ActiveRain's main [...]

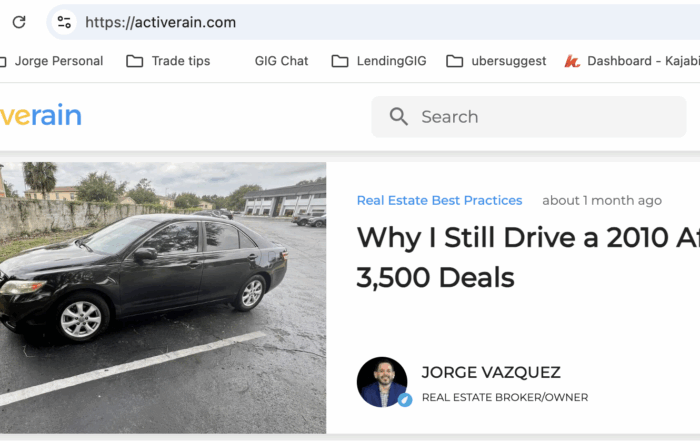

Jorge Vazquez Featured on ActiveRain for Real Estate Insight

Graystone Investment Group CEO Jorge Vazquez Featured on ActiveRain for Insightful Real Estate Blog Post FOR IMMEDIATE RELEASE Graystone CEO Jorge Vazquez Featured on ActiveRain for Viral Real Estate Blog [...]

For Sale: 4717 11th Ave S, St. Petersburg, FL 33711

4717 11th Ave S, St. Petersburg, FL 33711 • Single Family Home [...]

Pick your expert. Book your free 15-minute consult now. We are here to help!

Our Top Articles

Why You Should Sell Your Deals with Us

Let’s keep it real—wholesaling ain’t easy. You lock up a deal, hustle to find a [...]

Landlords, Listen Up: Florida’s A+ Economy Is Coming—Here’s Why 2025 Still Makes Sense

Florida’s A+ Economy in 2026: What This Means for Landlords, Renters, and Real Investors Like Me By Jorge Vazquez, [...]

What It Really Takes for Agents to Make Millions in Real Estate

What It Really Takes for Agents to Make Millions in Real Estate Inspired by a Fellow Featured Agent—Kat Palmiotti [...]

Property Profit Academy:

✔ Learn to buy properties with little to no money down.

✔ Build a $10M portfolio step by step.

✔ Master strategies like BRRRR and house hacking.