Understanding DSCR Loans for Real Estate Investment in Florida

Are you looking at Florida’s growing real estate market and wondering how to invest, even if you don’t have traditional proof of income? DSCR loans might be just the ticket. These loans let the property do all the talking, using its income to qualify for financing instead of relying on your personal paycheck.

Let’s break it down into simple steps so you can see why DSCR loans are so popular with investors.

What is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio. That might sound like a mouthful, but it’s just a fancy way of saying that a lender checks if the property you’re buying can make enough money to pay back the loan. In other words, it’s all about how much income the property brings in, not how much you make.

Think of it like this: the property is like a business. The more money it makes, the easier it is to cover expenses like loan payments and maintenance. The DSCR is a way of measuring this. If the property’s income is higher than the loan payments, you’re in good shape to get the loan.

Key Features of a DSCR Loan

Here are the main things you should know about DSCR loans:

-

Down Payment: You’ll need to put down about 20% to 25% of the property’s price. That means if you’re buying a house for $100,000, you’d need to have around $20,000 to $25,000 saved up.

-

Interest Rates: DSCR loans have higher interest rates compared to regular loans. As of March 2024, the rates are between 7% and 8%. Why? Because the lender is focusing on the property’s income, which is a bit riskier for them.

-

Credit Score: You need a good credit score to qualify—at least 680. Your credit score is kind of like your financial report card. The better it is, the more likely you’ll get approved.

-

No Need for Personal Income Proof: This is one of the coolest things about DSCR loans! The lender doesn’t care much about your job or how much money you make personally. All they care about is if the property will make enough money to pay back the loan. That’s why these loans are great for people who might not have a traditional job or steady income.

-

Financial Reserves: Lenders like to know you have a little backup money, just in case. You’ll typically need at least six months’ worth of mortgage payments saved up.

-

Prepayment Penalties: If you pay off the loan early, you might have to pay a fee. Lenders like to make money off the interest, so paying early can sometimes cost you.

-

Flexible Terms: You can choose how long you want the loan to last—anywhere from 5 to 30 years. Longer terms mean smaller monthly payments, but you’ll pay more interest over time.

-

Escrow for Taxes and Insurance: Part of your monthly payment goes into an escrow account. This account takes care of paying your property taxes and insurance so you don’t have to worry about it.

Why Are DSCR Loans Popular in Florida?

Now, why do so many investors love DSCR loans, especially in Florida? Well, Florida’s real estate market is hot! There’s a high demand for rental properties, and that means it’s easier to find properties that can generate a steady income.

Here’s why DSCR loans work so well in Florida:

-

Booming Rental Market: Florida has a ton of people moving in and looking for places to rent. This is good news for property owners because they can rent out their properties quickly. With rental income rolling in, it’s easier to cover the loan payments.

-

Income Over Personal Finances: Let’s say you’re self-employed or your personal income isn’t as steady as someone with a traditional job. DSCR loans don’t focus on your personal income. Instead, they look at whether the property can bring in enough cash. In Florida, where the rental market is strong, this can be a huge advantage.

-

Expand Your Portfolio: DSCR loans allow investors to grow their real estate portfolio faster. Because the loans are based on the property’s income and not your personal income, you can buy more properties as long as they make enough money. Florida’s high rental demand makes this even easier.

-

No Limits on Number of Properties: Traditional loans often limit how many properties you can own. DSCR loans don’t have this restriction, so if you’re looking to build a big real estate portfolio, this is a huge benefit.

Example of How a DSCR Loan Works in Florida

Let’s imagine you’re buying a rental home in Tampa for $200,000.

- You put down a 25% down payment, which is $50,000.

- The property earns $2,500 a month in rent.

- Your mortgage payment is $1,500 a month.

Because the property’s income ($2,500) is more than enough to cover the mortgage ($1,500), you would likely qualify for a DSCR loan. The lender sees that the property can easily handle its own loan payments, so they don’t need to worry as much about your personal income.

What Lenders Look for in a DSCR Loan

Lenders don’t just hand out DSCR loans to anyone. They have a few things they look at before approving you:

-

The DSCR Ratio: This is a ratio that compares the property’s income to its debt payments. Lenders like to see a DSCR of 1.25 or higher. This means the property makes 25% more than the debt payments. The higher the ratio, the better!

-

Property Type: DSCR loans are commonly used for investment properties like single-family homes, duplexes, and even apartment buildings. The property needs to be able to generate rental income.

-

Location: The property’s location is important too. Lenders want to know that the property is in a good area where rentals are in demand, like many parts of Florida.

How to Apply for a DSCR Loan in Florida

If you’re thinking about applying for a DSCR loan, here’s a simple step-by-step process to follow:

-

Research Lenders: Not all lenders offer DSCR loans. You’ll need to find one that specializes in them.

-

Prepare Your Documents: Even though you don’t need to show your personal income, you’ll still need paperwork showing the property’s potential income. This could include rental agreements, property appraisals, and more.

-

Save Up for the Down Payment: Remember, you’ll need around 20% to 25% for the down payment, so make sure you have enough saved up.

-

Check Your Credit: Make sure your credit score is at least 680 before you apply. If it’s lower, you might need to work on boosting it first.

-

Apply: Once you have everything ready, apply for the loan. The lender will evaluate the property’s income to decide if you qualify.

Is a DSCR Loan Right for You?

So, should you get a DSCR loan? Here are some things to think about:

-

Do you have the down payment saved up? If you can’t afford the 20% to 25% down payment, this might not be the best option.

-

Does the property make enough money? You’ll need to make sure the property can generate enough income to cover the loan payments and leave a little extra as a cushion.

-

Is your credit score high enough? If your credit is below 680, you might have trouble getting approved.

-

Can you handle the higher interest rates? DSCR loans usually have higher interest rates than traditional loans. Make sure you can manage the higher monthly payments.

Conclusion: Why DSCR Loans are a Smart Move for Florida Investors

Florida’s real estate market is booming, and DSCR loans can be a great way to tap into that growth without needing to rely on your personal income. With high demand for rental properties, it’s easier to find investments that can generate steady income, which is exactly what DSCR loans are designed to support.

These loans focus on the property’s income potential, which makes them perfect for investors who might not qualify for traditional loans. As long as the property can cover its loan payments, you’ve got a good chance of getting approved. So, if you’re ready to grow your real estate portfolio in Florida, a DSCR loan could be the key to unlocking new opportunities.

For more information about DSCR loans, visit: https://lendinggig.com/

Ready to take your real estate investing knowledge to the next level? Join our Property Profit Academy today! https://www.propertyprofitacademy.com

Tampa Bay Times Featured: Jorge Vazquez on Turning Storm Damage into Investment Gold

Jorge Vazquez2025-07-22T01:15:43+00:00July 21st, 2025|Comments Off on Tampa Bay Times Featured: Jorge Vazquez on Turning Storm Damage into Investment Gold

After the Storm: Why Investors Are the Real Heroes in Florida’s Housing Comeback By Jorge [...]

How to Create an HOA in Florida (And Why You Might Need One If You’re Buying Into a Condo Mess)

Jorge Vazquez2025-07-21T02:58:28+00:00July 21st, 2025|Comments Off on How to Create an HOA in Florida (And Why You Might Need One If You’re Buying Into a Condo Mess)

How to Create an HOA in Florida (And Why You Might Need One If You’re Buying Into a Condo [...]

Why So Many Condo Conversions Failed?

Jorge Vazquez2025-07-21T03:01:02+00:00July 21st, 2025|Comments Off on Why So Many Condo Conversions Failed?

Creating an HOA When You Own the Whole Building (And Why So Many Condo Conversions Fail Without One) Let’s [...]

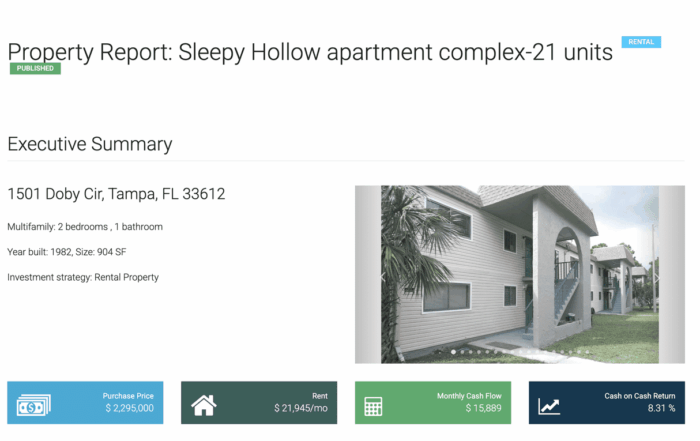

The Real Numbers Behind My $2.3M Multifamily Deal (Sleepy Hollow P&L Breakdown)

Jorge Vazquez2025-07-21T03:08:12+00:00July 21st, 2025|Comments Off on The Real Numbers Behind My $2.3M Multifamily Deal (Sleepy Hollow P&L Breakdown)

Title: The Real Numbers Behind My $2.3M Apartment Deal (Made Simple) Let’s keep it real. You can talk about [...]

How I Went from Losing 22 Properties to Perfect Credit, 40 Properties, and $500K+ in Credit Lines

Jorge Vazquez2025-07-20T21:49:35+00:00July 20th, 2025|Comments Off on How I Went from Losing 22 Properties to Perfect Credit, 40 Properties, and $500K+ in Credit Lines

How I Went from Losing 22 Properties to Perfect Credit, 40 Properties, and $500K+ in [...]

How I Qualified Tenants for Lease Options in 2005 (And Why It Still Works in 2025)

Jorge Vazquez2025-07-20T21:56:17+00:00July 20th, 2025|Comments Off on How I Qualified Tenants for Lease Options in 2005 (And Why It Still Works in 2025)

How I Qualified Tenants for Lease Options in 2005 (And Why It Still Works in 2025) Let’s rewind to [...]

Meet our Team of Experts!

Meet Vanessa Martin, the Lending Operations Manager

Vanessa has over 23 years of business management experience and has been in the real estate industry since 2018. She and her team prioritize serving clients and finding the right financing options. Schedule a meeting with Vanessa: https://graystoneig.com/vanessa

Meet Cody Bergstrom, Your Expert in Finding Deals

My team and I have over 20 years of experience in real estate. We have strong relationships with wholesalers, probate lawyers, sellers, and others in Florida. I aim to align your investments with your vision and deliver exceptional results. Contact Vanessa to schedule a meeting: https://graystoneig.com/cody

Meet Marylyn Patankar, Your Property Manager Partner

Hello, I’m Marylyn Patankar, the Field Manager and New Client Ambassador at Graystone Property Management. I educate investors about our perks, onboard new landlord investors, and manage on-site operations. Schedule a meeting with me here: https://graystoneig.com/marylyn