🏠 Intro: Cap Rate Confusion? You’re Not Alone.

Let’s be real—every new investor hits this question early:

“What is a good cap rate when buying a rental?”

Google it, and you’ll get everything from 4% to 12%.

Ask 10 investors, you’ll get 11 answers.

Even some agents toss around numbers they don’t fully understand.

But after two decades in this game—owning over 30 rentals, managing hundreds, and doing over 3,500 deals—I’ve seen what works, what doesn’t, and what sounds good but turns into a cash-eating nightmare.

So I’m going to give it to you straight, in plain English. No overthinking, no math degree required.

📊 Cap Rate 101: The Quick Explanation

Cap rate stands for capitalization rate. It’s one of the most common ways investors measure the potential return on a rental property.

Here’s the formula:

Cap Rate = Net Operating Income (NOI) ÷ Property Value

Let’s break that down:

-

Net Operating Income is your income after expenses—things like taxes, insurance, maintenance, and vacancy, but not mortgage payments.

-

Property Value is either what you paid or what it’s worth today.

Example:

You buy a rental for $250,000.

It brings in $24,000 per year after expenses.

That’s a cap rate of 9.6% (24,000 ÷ 250,000).

Simple, right?

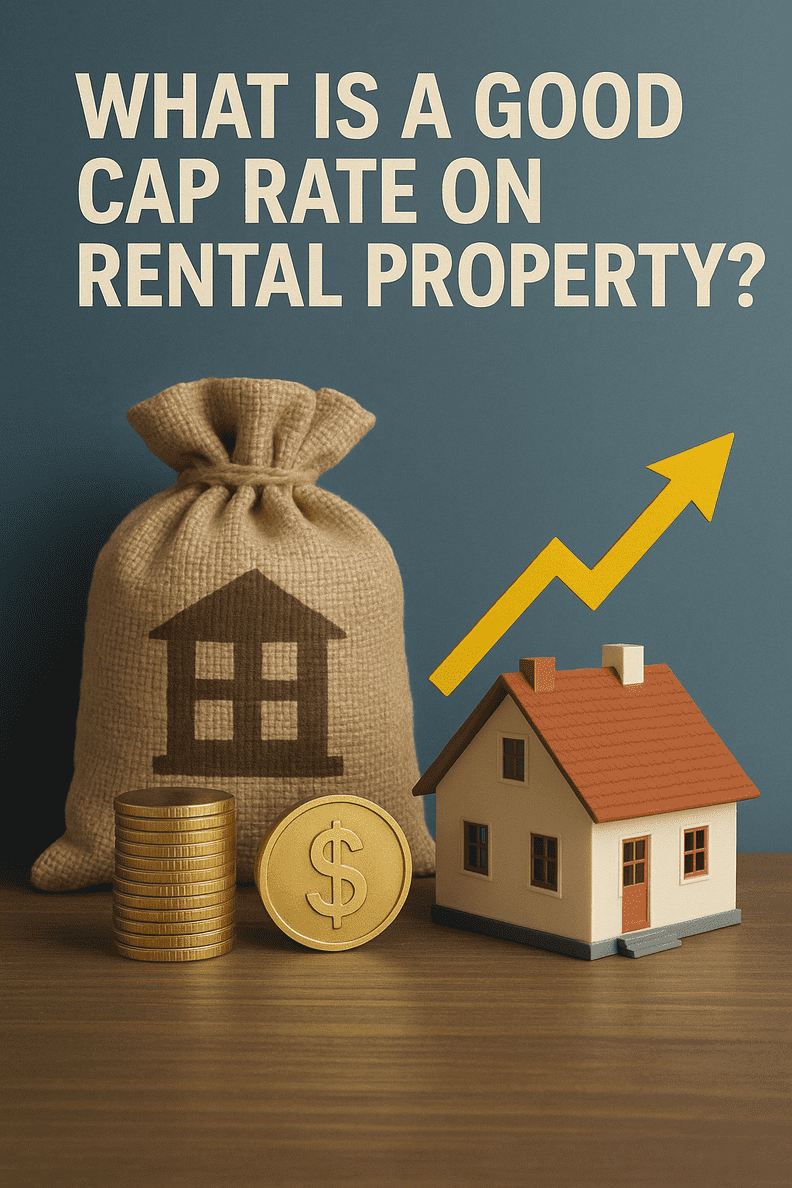

✅ So What’s a Good Cap Rate on Rental Property?

Short answer? It depends. But let me give you a cheat sheet:

| Cap Rate | What It Usually Means |

|---|---|

| 3%–4% | Low risk, fancy neighborhood, low returns |

| 5%–6% | Stable, predictable—great for long-term holds |

| 7%–8% | Strong balance of cash flow and stability |

| 9%–10%+ | High cash flow—but expect more headaches |

If you’re a conservative investor, 5% to 6% in a great area with low vacancy might be ideal.

If you’re like me and looking for strong returns without going full slumlord, 7% to 9% is the sweet spot.

But if someone pitches you a 12% cap rate?

You’d better check for roof leaks, bad tenants, or worse—because nothing comes without a tradeoff.

🏙️ Location Makes or Breaks Cap Rate

A 7% cap rate in Tampa Bay? That’s a solid deal.

A 7% cap rate in a declining area with boarded-up homes? That’s a trap.

Cap rates are 100% location-dependent. Here’s what I see in real time:

-

Tampa Bay: Still find 7%–9% cap rates in gentrifying areas

-

Miami & Fort Lauderdale: 3%–5% cap rates, but long-term appreciation

-

Central Florida: 6%–8% range if you move fast and know what you’re doing

-

Rural Florida: 10%–12% cap rates, but you’ll work for every dollar

Just remember: High cap rate = high risk more often than not. Know the why behind the number.

🧠 Cap Rate Is a Starting Point—Not the Whole Picture

Here’s the trap I see too many rookies fall into:

They chase the highest cap rate and ignore everything else.

Let me be clear: Cap rate does not factor in financing.

It doesn’t tell you what you’re putting in or how you’re funding it.

Want the real number that matters?

Cash-on-Cash Return = Cash Flow ÷ Money You Invested

If you put $40,000 down on a rental and make $4,000 per year in profit after all costs (including your mortgage), that’s a 10% return on your actual money.

Now we’re talking.

So yes, cap rate is useful—it tells you how hard the property works before debt. But it’s only one tool. Use it with:

-

Cash-on-cash return

-

Rent appreciation potential

-

Vacancy trends

-

Tenant quality in that zip code

🔎 What Drives Cap Rate in 2025?

In today’s market, several things are moving the needle:

-

Interest rates – As they shift, sellers adjust pricing, which impacts cap rates.

-

Insurance costs – Especially in Florida, these can crush your NOI if you’re not careful.

-

Local policy – Cities that favor landlords often have better cap rate potential.

-

Demand for housing – High rents = higher NOI = better cap rate.

You’ve got to stay local, stay current, and study what’s actually happening in your market.

At Graystone, we’ve spent years perfecting this for investors. We don’t just run numbers—we understand the real story behind them.

❌ Cap Rate Rookie Mistakes

Let’s talk about what not to do.

🚫 Buying on cap rate alone.

Just because it’s 9% doesn’t mean it’s a deal. That tenant might be late every month or the roof could be toast.

🚫 Using listing income numbers.

Always verify with real rent rolls and actual expenses.

🚫 Ignoring vacancy risk.

That shiny 10% cap rate means nothing if the property sits empty 3 months a year.

🚫 Forgetting about your financing.

If you’re financing the deal, your return could shift significantly. Know your monthly nut.

🧰 Jorge’s Sweet Spot

After two decades of owning and managing properties across Florida, I can tell you:

-

My ideal cap rate: 7%–9%

-

My deal-breaker cap rate: Under 5% in a low-growth area

-

My exception: I’ll consider 5% cap rates only if I’m buying in a premium neighborhood with strong upside

This balance gives me cash flow today and appreciation tomorrow.

💬 Final Thoughts: What Is a Good Cap Rate?

A good cap rate:

-

Works in your market

-

Matches your risk tolerance

-

Leaves room for cash flow, reserves, and upside

-

Still makes sense after your mortgage

Don’t overthink it.

Don’t blindly trust online calculators.

Run your numbers. Know your area. Be honest about what kind of investor you are.

That’s how you win.

Written by CEO of Graystone & companies & Coach of the Property Profit Academy

Ready to connect and strategize? Contact me at graystoneig.com/ceo – Jorge Vazquez, CEO of Graystone Investment Group & its subsidiary companies and Coach at Property Profit Academy.

Pick your expert. Book your free 15-minute consult now. We are here to help!

Our Top Articles

Tampa Rental Market 2025: What to Expect in Q3 and Q4

Let’s talk landlord to landlord. Between the 40+ properties I personally own and the nearly 300 I manage with [...]

House Hacking in Florida: Live Free, Build Wealth, and Laugh at Your Mortgage

House Hacking in Florida: Live Free, Build Wealth, and Laugh at Your Mortgage Let’s be honest—renting in Florida in [...]

Tampa Bay Times Featured: Jorge Vazquez on Turning Storm Damage into Investment Gold

After the Storm: Why Investors Are the Real Heroes in Florida’s Housing Comeback By Jorge [...]

Property Profit Academy:

✔ Learn to buy properties with little to no money down.

✔ Build a $10M portfolio step by step.

✔ Master strategies like BRRRR and house hacking.