The Market Will Not Crash in 2025: Why Savvy Investors Should Stay Confident

As 2025 approaches, speculation about a real estate market crash is growing louder. Homeowners, buyers, and investors are asking, “Will home prices crash in Florida?” and “Is now the right time to invest, or should I wait?” The media fuels uncertainty, with dramatic headlines predicting everything from price collapses to market bubbles. But let’s separate fact from fear—while the real estate market is experiencing shifts, a full-blown crash is highly unlikely.

Unlike the 2008 financial crisis, today’s housing market is built on stronger lending standards, limited housing supply, and sustained demand—especially in key markets like Florida. Instead of bracing for a downturn, savvy investors recognize that 2025 presents a rare opportunity. Interest rates are expected to decline, stabilizing home prices and bringing buyers back into the market. Florida, in particular, continues to attract new residents, keeping demand high and ensuring property values remain resilient.

Rather than fearing a crash, investors should focus on capitalizing on market adjustments. Those who understand the underlying trends can secure great deals now, positioning themselves for long-term appreciation and steady rental income. The key is not to panic—but to prepare, adapt, and seize the opportunities that shifting markets create.

Understanding the Current Market Climate

After nearly a decade of substantial growth and interest in properties, particularly in South Florida, the real estate market is showing signs of stabilization. This shift, while noticeable, does not indicate an impending crash but rather a natural progression toward a more balanced market. The fervor that characterized the past ten years is cooling, allowing the market to find its footing and offering investors a more predictable landscape.

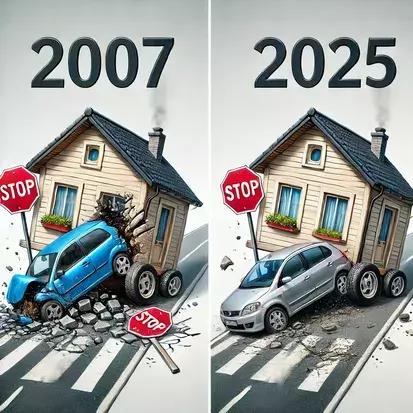

Historical Context: Why 2025 Is Not 2008

To understand why a market crash is unlikely in 2025, it’s essential to compare the current situation with the events leading up to the 2008 housing market crash. In 2008, the real estate market was plagued by loose lending practices, an oversupply of speculative investments, and a significant drop in housing demand, all of which culminated in the financial crisis. The market was flooded with subprime mortgages, and many homeowners found themselves unable to keep up with their mortgage payments, leading to a wave of foreclosures.

Today, the situation is markedly different. Lending standards have tightened significantly since the Great Recession. The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, introduced stricter regulations for lending institutions, ensuring that borrowers are more qualified and less likely to default on their loans. Additionally, the supply of homes is not outpacing demand as it did in the early 2000s. Instead, there is still a relatively low inventory of homes available, particularly in high-demand areas like Florida, which helps maintain price stability.

The Impact of Interest Rates on the Housing Market

One of the most significant factors affecting the real estate market in 2025 will be interest rates. Over the past few years, the Federal Reserve has been gradually increasing interest rates to combat inflation. However, as of this month, we are now entering a deflationary period, marked by a slight uptick in unemployment and inflation dropping below 3%. This shift has led the Federal Reserve to consider a series of rate reductions, potentially lowering rates by 1-3% before the end of 2024.

The anticipated rate reductions are a positive signal for the housing market. Lower interest rates make borrowing more affordable, which can stimulate demand for homes and support property values. While higher rates earlier in the cycle may have cooled the market, the expected rate cuts could provide a soft landing, preventing any sharp declines in property prices. This scenario is far from a crash and more indicative of a healthy correction that prevents the market from overheating.

The Gig Economy and Job Market Resilience

Another critical factor contributing to the market’s stability is the resilience of the job market and the rise of the gig economy. Unlike the situation in 2008, where mass layoffs and high unemployment rates contributed to the housing crisis, today’s job market remains relatively robust, even with the recent slight increase in unemployment. Many people are finding new ways to generate income, thanks to the gig economy.

Platforms like Uber, Airbnb, and various online marketplaces have empowered individuals to supplement their income, making it easier for them to keep up with mortgage payments even in challenging economic times. This added financial flexibility reduces the risk of widespread foreclosures, which was a significant factor in the 2008 crash. The combination of a resilient job market and new income opportunities through the gig economy provides a safety net for homeowners, further reducing the likelihood of a market crash.

Why the Florida Real Estate Market Remains Strong

Florida’s real estate market is unique, and several factors contribute to its continued strength, making a crash unlikely. Florida is one of the fastest-growing states in the U.S., with thousands of people moving to the state each month. The influx of new residents drives demand for housing, particularly in desirable areas like South Florida, Tampa, and Orlando.

Population Growth and Housing Demand

Florida’s population growth is a key driver of its real estate market. The state has been a popular destination for retirees, snowbirds, and remote workers, all of whom are attracted by Florida’s warm climate, low taxes, and affordable cost of living. This steady population growth ensures that there is a constant demand for housing, which helps support property values.

Even as the market stabilizes, Florida’s ongoing population growth will continue to create demand for homes. Unlike other regions that may experience a decline in housing demand due to population stagnation or decline, Florida’s market benefits from a consistent influx of new residents. This population growth acts as a buffer against any potential downturns, making a market crash less likely.

The Resilience of the Luxury Market

Another factor that bolsters Florida’s real estate market is the resilience of the luxury market. South Florida, in particular, has become a hotspot for luxury real estate, attracting wealthy buyers from across the country and around the world. These buyers are often less sensitive to fluctuations in interest rates and economic conditions, making the luxury market more stable than other segments of the housing market.

Luxury properties in areas like Miami, Palm Beach, and Naples continue to see strong demand, even as the broader market cools. This demand is driven by both domestic buyers seeking second homes and international buyers looking for a safe haven for their wealth. The stability of the luxury market helps support overall property values in Florida, further reducing the likelihood of a crash.

Investment Opportunities in a Stabilizing Market

For investors, the current market conditions in Florida represent a unique opportunity. As the market stabilizes, inexperienced or panicked sellers may be more willing to accept lower offers, creating opportunities for savvy investors to acquire properties at a discount. This short window of opportunity allows investors to capitalize on the fear and uncertainty that can cause less experienced buyers to exit the market.

The New “Flipper Market”: Knowledge and Effort as Key Drivers

The real estate market in 2025 will be defined by knowledge and effort. The days of easy money from flipping properties are over; today’s flippers need to be more strategic and well-informed to succeed. Investors who are willing to put in the time to research the market, identify undervalued properties, and make the necessary updates will find ample opportunities to make a profit.

Conversely, those with less experience or who rely on outdated strategies may struggle. The current market favors those who are willing to adapt and learn. The “fly-by” investors who entered the market during the boom years without a deep understanding of real estate fundamentals are likely to exit the market, leaving the field open for more knowledgeable investors.

The Importance of Stress Testing Your Investments

Given the current market dynamics, it’s more important than ever for investors to stress test their investments. A rental/flip stress test involves evaluating how your property would perform under various economic conditions, including different interest rate environments, changes in rental demand, and fluctuations in property values.

Conducting a stress test allows you to identify potential risks and make informed decisions about your investment strategy. For example, if you’re considering a flip, you need to factor in the possibility of longer holding periods or lower-than-expected sale prices. By preparing for these scenarios, you can ensure that your investments remain profitable even in a cooling market.

Long-Term Appreciation: The Key to Real Estate Success

One of the most important lessons I’ve learned over 20 years in the real estate business is the value of long-term appreciation. While it can be tempting to focus on short-term gains, particularly in a hot market, the real wealth in real estate comes from holding properties over the long term.

Even if the market cools in 2025, property values in Florida are likely to appreciate over time. Florida’s population growth, favorable tax environment, and strong job market all support long-term property value increases. By focusing on long-term appreciation, investors can ride out short-term market fluctuations and build lasting wealth.

The Myth of Market Timing

One of the biggest mistakes investors can make is trying to time the market. Predicting the exact moment when the market will peak or bottom out is nearly impossible, even for seasoned professionals. Instead of trying to time the market, investors should focus on buying quality properties at fair prices and holding them for the long term.

By adopting a long-term perspective, you can avoid the stress and uncertainty that comes with trying to time the market. Even if prices dip temporarily, the long-term trend for real estate values in Florida is upward. By holding onto your properties, you can benefit from this long-term appreciation and build substantial wealth over time.

Why the Market Will Not Crash in 2025

Given the factors discussed above, it’s clear that the market will not crash in 2025. While we may see some cooling in certain areas, particularly those that experienced the most significant price increases during the boom years, the underlying fundamentals of the Florida real estate market remain strong.

Population growth, job market resilience, and the gig economy all contribute to a stable housing market. Additionally, the luxury market and the demand from international buyers provide further support for property values. As long as these factors remain in place, a crash is unlikely.

The Role of Federal Reserve Rate Reductions

The expected interest rate reductions before the end of 2024 further bolster the case for a stable housing market. As we enter a deflationary period, with inflation dipping below 3% and a slight rise in unemployment, the Federal Reserve is poised to reduce rates by 1-3%. These rate cuts will make mortgages more affordable, potentially leading to a rebound in the housing market and preventing any significant downturns.

The rate reductions are a clear indication that the Federal Reserve is committed to maintaining economic stability. By lowering interest rates, the Fed aims to stimulate borrowing and investment, which can help support property values and sustain market demand. This proactive approach by the Federal Reserve further reduces the likelihood of a market crash in 2025.

The Takeaway for Investors

As we move into 2025, investors should remain confident in the stability of the real estate market, particularly in Florida. While the market may not offer the same explosive growth as in previous years, there are still ample opportunities for those who are willing to put in the effort and have the necessary knowledge.

The key to success in this market is preparation. Conduct stress tests on your investments, focus on long-term appreciation, and avoid the temptation to time the market. The expected interest rate cuts and the resilience of the job market, combined with Florida’s ongoing population growth, all point to a stable and potentially lucrative market in 2025.

Is the Florida Real Estate Market Going to Crash? (Part 2 Update)

If you’re like most people, you probably hear all kinds of crazy talk about the housing market. Your neighbor says it’s going to crash. Your uncle swears he read it on Facebook. But let me tell you the real deal—after investing in Florida real estate for over 20 years, I can confidently say: Don’t panic!

Let’s break it down so even a 10-year-old (or your uncle) can get it.

Recent Market Updates (2025 Trends So Far)

Since our last deep dive into the Florida real estate market, a few important things have happened that we need to talk about. Think of this as Part 2 —like when your favorite movie gets a sequel (but this one is less explosions and more home prices).

1. Interest Rates Are Showing Signs of Dropping

Remember how we were hoping the Federal Reserve would ease up on those sky-high rates? Well, it’s finally starting to happen! We’ve seen the first signs of mortgage rates dipping below 7% in early 2025. This has started bringing back those buyers who were hiding under a rock last year. When rates drop, people feel more confident buying, and demand pushes prices up again.

2. Buyers Are Back, But Sellers Are Holding

It’s like the classic middle school dance—buyers are eager to step onto the floor, but sellers are still hugging the wall. Homeowners who locked in super-low mortgage rates in 2020-2021 are in no rush to sell. Why give up a 3% rate for a 6.5% one? That means inventory is still tight. Less inventory + more buyers = prices staying firm.

3. Florida Population Growth Isn’t Slowing

If anything, it’s speeding up. Data from the Florida Chamber of Commerce shows that about 1,000 people move to Florida every day. That’s a whole lot of snowbirds, retirees, and remote workers hunting for homes. Demand remains strong, especially in hot spots like Tampa, Orlando, and Miami.

4. Insurance Costs Are Still Painful, But Solutions Are Emerging

Yes, insurance rates in Florida still make people wince. Hurricanes and past fraud made it worse. But here’s the thing—the government and private insurers are getting creative. More companies are entering the market, giving homeowners better options. It’s not perfect, but it’s improving.

5. Rental Market Is Booming

With homeownership still a challenge for some, rentals are thriving. Landlords are smiling. Rents are high, vacancies are low, and investors are seeing great cash flow. Florida remains a landlord-friendly state, making it a solid spot for buy-and-hold investors.

6. Builders Are Picking Up the Pace (A Little)

Builders are finally speeding up (they took their two-hour break). We’re seeing more construction projects start in 2025, but it will take time to fill the housing gap. Don’t expect an oversupply anytime soon.

So, Is the Florida Real Estate Market Going to Crash in 2025?

Still no. We are not seeing anything close to a crash. There may be slight price adjustments in certain areas, but overall, Florida real estate remains strong. If you’re waiting for a 2008-style bargain bin sale, you might be waiting a long time.

Pro Tip for Investors (Part 2 Version):

If rates keep dropping, demand will surge again. Getting in now could mean locking in a good deal before the next wave of buyers floods the market.

Final Takeaway: Is the Real Estate Market Going to Crash in 2025? Here’s What You Need to Know

As speculation continues, many wonder: Is the real estate market going to crash in 2025? The answer is no—here’s why:

✔ Interest rates are improving – Lower mortgage rates are fueling buyer demand.

✔ Buyers are returning – As affordability increases, the market is gaining momentum.

✔ Sellers are holding firm – Homeowners with low mortgage rates are reluctant to sell, keeping inventory tight.

✔ Florida remains a top destination – Rapid population growth continues to drive home prices.

✔ Insurance costs are stabilizing – New policies and competition are helping homeowners manage expenses.

✔ Rental properties are thriving – High demand for rentals is creating strong cash flow for investors.

How to Win in 2025’s Market

📈 Stay informed – Follow market trends and interest rate changes.

🏡 Be patient – Smart investments require timing and strategy.

💡 Act wisely – Position yourself in high-growth markets like Florida to maximize returns.

The Florida real estate market is full of opportunity—but only for those who understand the trends and act strategically.

🚀 Want to Master Real Estate Investing?

Don’t just speculate—learn how to invest wisely! The Property Profit Academy is your step-by-step guide to profitable real estate deals.

🎯 Start building wealth today: Property Profit Academy

Jorge Vazquez, CEO

Pick your expert. Book your free 15-minute consult now. We are here to help!

Our Top Articles

Are Five-Year ARM Loans Safe in 2025?

Jorge Vazquez2025-08-05T01:35:57+00:00August 5th, 2025|Comments Off on Are Five-Year ARM Loans Safe in 2025?

Are Five-Year ARM Loans Safe in 2025? By Jorge Vazquez, CEO of Graystone Investment Group Let’s be real—how many [...]

The Best Cash-Flowing Markets Are Not the Best BRRRR Markets

Jorge Vazquez2025-08-04T19:30:33+00:00August 4th, 2025|Comments Off on The Best Cash-Flowing Markets Are Not the Best BRRRR Markets

A new investor asked me this online today: “Jorge, what’s the best cash-flowing market for the BRRRR strategy?” I [...]

Why Affordable Properties Are Still the Smartest Way to Build Wealth in 2025

Jorge Vazquez2025-08-04T00:45:38+00:00August 2nd, 2025|Comments Off on Why Affordable Properties Are Still the Smartest Way to Build Wealth in 2025

By Jorge Vazquez, CEO of Graystone Investment Group Introduction: Picking Up Where We Left Off So, you [...]

Property Profit Academy:

✔ Learn to buy properties with little to no money down.

✔ Build a $10M portfolio step by step.

✔ Master strategies like BRRRR and house hacking.