Community Property vs. Community Property with Right of Survivorship

When you’re getting into real estate, understanding the different ways to own property is a big deal—especially if you’re married and buying property in a state that recognizes community property. Let’s break it down in simple terms so you can figure out which ownership option is right for you.

What is Community Property?

Community property is a form of ownership available to married couples in certain states (like California, Texas, and Arizona). Here’s how it works:

-

Ownership Split: Both spouses equally own any property acquired during the marriage. Think 50/50, no matter who earned the money or whose name is on the title.

-

Exceptions: Anything you owned before the marriage or inherited/gifted during the marriage usually doesn’t count as community property.

-

Taxes Perk: When one spouse passes away, the surviving spouse gets a stepped-up basis on the property’s value for tax purposes. This can save a ton in capital gains tax if you decide to sell.

-

Probate: Here’s the downside: unless you have a will or living trust, the deceased spouse’s share could get tied up in probate court.

What is Community Property with Right of Survivorship?

Community property with right of survivorship (CPWROS) is like community property but with an upgrade. When one spouse passes away:

-

Automatic Transfer: The deceased spouse’s share automatically goes to the surviving spouse without needing probate.

-

Stepped-Up Basis: You still get the tax benefit of a stepped-up basis.

-

Simplicity: It’s cleaner, faster, and avoids the legal headaches of probate.

Key Differences

Let’s stack these two options side by side:

Why Does This Matter?

Here’s a scenario to make it real:

You and your spouse own a rental property in California worth $500,000. You bought it for $200,000, so there’s $300,000 in appreciation. If your spouse passes away and you’re holding the property as community property, their 50% share might go through probate unless you planned ahead. With CPWROS, their share automatically transfers to you, and you avoid that headache entirely. Plus, you’d get a new tax basis based on today’s value for the whole property, not just their half. Translation: less tax if you sell down the road.

States That Allow Community Property

Community property laws are only recognized in certain states:

-

Arizona

-

California

-

Idaho

-

Louisiana

-

Nevada

-

New Mexico

-

Texas

-

Washington

-

Wisconsin

Not every state allows CPWROS, so double-check the rules in your area.

How to Decide

Here are a few tips to help you choose:

-

Talk to an Expert: A real estate attorney or estate planner can help you weigh your options. What’s good for taxes might not align with your long-term goals.

-

Think About Probate: If avoiding probate is a priority, CPWROS might be the way to go.

-

Plan for the Future: Consider your family, your assets, and how you want things handled if one spouse passes away.

-

Be Specific: Even with CPWROS, you’ll still want a will or trust for any other assets you own.

Final Thoughts

Choosing between community property and community property with right of survivorship is a big decision. If you’re married and living in a community property state, this choice affects taxes, probate, and what happens to your property after one of you passes. Take your time, talk to a pro, and pick the option that fits your life best.

Written by CEO of Graystone & companies & Coach of the Property Profit Academy.

http://propertyprofitacademy.com

Keep it consistent, stay patient, stay true—if I did it, so can you! Ready to learn? Let me guide you at propertyprofitacademy.com – Jorge Vazquez, CEO of Graystone Investment Group & its subsidiary companies and Coach at Property Profit Academ

OUR BEST ARTICLES

House Hacking in Florida: Live Free, Build Wealth, and Laugh at Your Mortgage

Jorge Vazquez2025-07-23T01:17:06+00:00July 23rd, 2025|Comments Off on House Hacking in Florida: Live Free, Build Wealth, and Laugh at Your Mortgage

House Hacking in Florida: Live Free, Build Wealth, and Laugh at Your Mortgage Let’s be honest—renting in Florida in [...]

Tampa Bay Times Featured: Jorge Vazquez on Turning Storm Damage into Investment Gold

Jorge Vazquez2025-07-22T01:15:43+00:00July 21st, 2025|Comments Off on Tampa Bay Times Featured: Jorge Vazquez on Turning Storm Damage into Investment Gold

After the Storm: Why Investors Are the Real Heroes in Florida’s Housing Comeback By Jorge [...]

How to Create an HOA in Florida (And Why You Might Need One If You’re Buying Into a Condo Mess)

Jorge Vazquez2025-07-21T02:58:28+00:00July 21st, 2025|Comments Off on How to Create an HOA in Florida (And Why You Might Need One If You’re Buying Into a Condo Mess)

How to Create an HOA in Florida (And Why You Might Need One If You’re Buying Into a Condo [...]

Why So Many Condo Conversions Failed?

Jorge Vazquez2025-07-21T03:01:02+00:00July 21st, 2025|Comments Off on Why So Many Condo Conversions Failed?

Creating an HOA When You Own the Whole Building (And Why So Many Condo Conversions Fail Without One) Let’s [...]

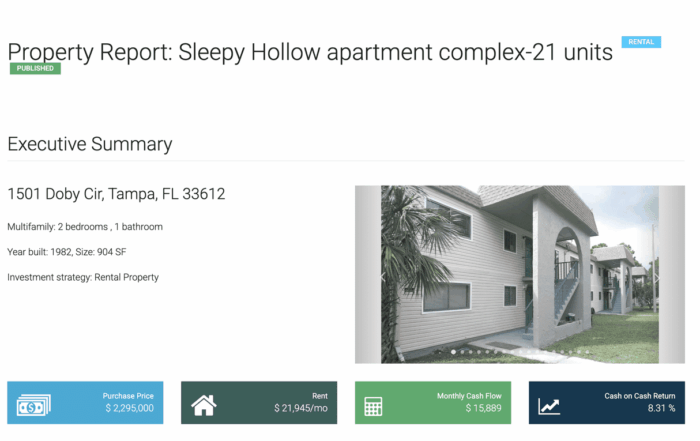

The Real Numbers Behind My $2.3M Multifamily Deal (Sleepy Hollow P&L Breakdown)

Jorge Vazquez2025-07-21T03:08:12+00:00July 21st, 2025|Comments Off on The Real Numbers Behind My $2.3M Multifamily Deal (Sleepy Hollow P&L Breakdown)

Title: The Real Numbers Behind My $2.3M Apartment Deal (Made Simple) Let’s keep it real. You can talk about [...]

How I Went from Losing 22 Properties to Perfect Credit, 40 Properties, and $500K+ in Credit Lines

Jorge Vazquez2025-07-20T21:49:35+00:00July 20th, 2025|Comments Off on How I Went from Losing 22 Properties to Perfect Credit, 40 Properties, and $500K+ in Credit Lines

How I Went from Losing 22 Properties to Perfect Credit, 40 Properties, and $500K+ in [...]

Meet our Team of Experts!

Meet Cody Bergstrom, Your Expert in Finding Deals

My team and I have over 20 years of experience in real estate. We have strong relationships with wholesalers, probate lawyers, sellers, and others in Florida. I aim to align your investments with your vision and deliver exceptional results. Contact Vanessa to schedule a meeting: https://graystoneig.com/cody

Meet Lisa Kaye Price, the LendingGig Top MLO

Lisa-Kaye Price – Real Estate Lending Specialist

With 20 years in real estate, Lisa-Kaye is dedicated to helping clients achieve their investment goals through strategic financing. She and her team focus on securing the best financing solutions to maximize leverage – a unique advantage of real estate investing.

Offering various options, including conventional loans, asset-backed and private money solutions, and programs for foreign nationals, Lisa’s expertise ensures clients get the support they need, whether buying new properties or refinancing.

Schedule a meeting with Lisa: https://graystoneig.com/lisa-kaye-price

Meet Marylyn Patankar, Your Property Manager Partner

Hello, I’m Marylyn Patankar, the Field Manager and New Client Ambassador at Graystone Property Management. I educate investors about our perks, onboard new landlord investors, and manage on-site operations. Schedule a meeting with me here: https://graystoneig.com/marylyn