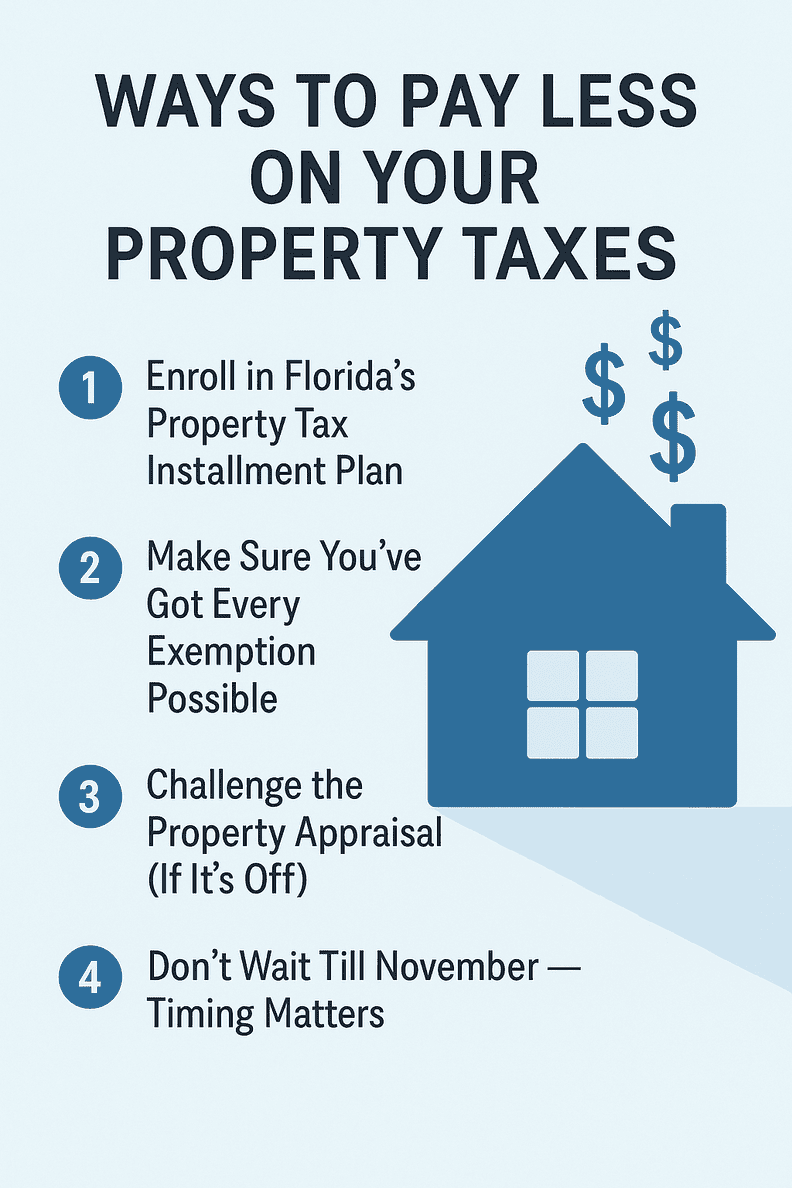

Ways to Pay Less on Your Property Taxes (Without Doing Anything Shady)

By Jorge Vazquez, CEO of Graystone Investment Group

Property taxes. They’re like your HOA fees, but with more zeros and fewer angry Facebook threads. If you’ve ever looked at your bill and thought, “There’s gotta be a better way,”—you’re right. There is.

I’ve been in real estate over 20 years, done 3,500+ deals, and own over 40 properties. And I’m here to tell you: there are real, legal, low-effort ways to pay less on your property taxes.

Let’s start with the one I just used—and fell in love with.

1. Enroll in Florida’s Property Tax Installment Plan

This is hands-down one of the best kept secrets for Florida property owners. You don’t even need a lawyer or an accountant—just a calendar and a little adulting.

Here’s what it does: Instead of paying one big chunk in November, you split your property taxes into four smaller payments across the year—and you get discounts for paying early.

Breakdown:

-

June: 6% discount

-

September: 4.5% discount

-

December: 3% discount

-

March: no discount, but by then you’re ¾ done

I just used it for the first time and already saved $46.32 on the first bill. Not bad for just showing up early.

2. File for Homestead Exemption (If You Live There)

If the property is your primary residence, make sure you file for the Florida Homestead Exemption. You can shave up to $50,000 off your taxable value, and it caps how much your taxes can go up each year.

It’s the state’s way of saying, “Thanks for sticking around.”

Heads up: You must apply by March 1st of the tax year. Miss the deadline, and you’re back to paying full price.

3. Appeal Your Property Appraisal

Florida counties assess your property’s value every year. If they overshoot it — and they do, often — you could be paying taxes on an inflated value.

You can:

-

Check your property record for errors (wrong square footage, pool you don’t have, etc.)

-

Hire a local appraiser to get a second opinion

-

File an appeal with your county’s Value Adjustment Board (VAB)

It’s like checking

Perfect! Here’s your updated article with the new title, humor intact, and all the SEO elements tailored to “Ways to Pay Less on Your Property Taxes.”

Ways to Pay Less on Your Property Taxes (Without Hiding From the Tax Man)

By Jorge Vazquez, CEO of Graystone Investment Group

Let’s be real: property taxes are that one yearly guest that shows up uninvited, eats all your cash, and somehow still expects a thank-you card. But what if I told you there are real ways to pay less—legally, easily, and without wearing a disguise to the Tax Collector’s office?

This isn’t tax evasion. It’s called strategy, and I’m about to break down one of my favorite moves: Florida’s Property Tax Installment Plan—plus a few extra ways to keep your money working for you, not against you.

1. Break Up the Bill With Florida’s Installment Plan

Most people pay their entire property tax bill at once and then wonder why their checking account needs therapy. Not me. I finally tried out the installment plan, and let me tell you, I’m a fan.

How it works:

-

Pay your taxes in four smaller chunks instead of one giant lump sum.

-

You get discounts just for paying early. I saved $46.32 on my first payment.

-

You don’t even have to think—just set up autopay and enjoy being financially responsible with no effort.

Payment Schedule:

-

June: ¼ of last year’s taxes, 6% discount

-

September: Another ¼, 4.5% discount

-

December: Based on this year’s estimate, 3% discount

-

March: Final balance, no discount (but no surprises either)

Pro tip: This plan is gold for landlords with multiple properties. Keeps your cash flow smooth and your accountant smiling.

2. Make Sure You’ve Got Every Exemption Possible

Florida offers several property tax exemptions. If you’re not claiming them, you might as well be donating extra cash to the county.

Here are the big ones:

-

Homestead Exemption: Save up to $50,000 off your home’s assessed value.

-

Senior Citizen Exemption: If you’re 65+ with limited income, this one’s for you.

-

Veterans & Disability Exemptions: If you qualify, these can shave off a chunk.

-

Widow/Widower Exemption: Yup, even life events come with savings sometimes.

Check your county’s property appraiser site. You’d be shocked how many folks don’t even know they’re eligible.

3. Challenge the Property Appraisal (If It’s Off)

You ever look at your tax bill and think, “There’s no way my property is worth that much!” Well, good news—you don’t have to just take it.

If you believe your property is over-assessed, you can file an appeal. Bring comps, pictures, and a calm voice (yelling doesn’t help—it’s been tested). This one move could drop your tax bill significantly.

4. Watch Out for Sneaky Taxable Add-Ons

Sometimes you unknowingly trigger a reassessment when you:

-

Pull permits for a pool or renovation

-

Add square footage

-

Change zoning or usage

Those upgrades can lead to higher tax assessments. I’m not saying don’t upgrade—just go in with eyes wide open. If you’re house hacking or turning units into Airbnbs, be strategic. Sometimes it’s smarter to make improvements without triggering a reassessment right away.

5. Don’t Wait Till November — Timing Matters

Florida offers a 4% discount if you pay your tax bill in November. It drops to 3% in December, 2% in January, and 1% in February. Miss those dates? You pay the full amount or worse—late fees.

Moral of the story? Pay early = pay less.

Quick Story: My $0 Tax Bill Surprise

This year, I logged into my Pasco account to check on my property taxes. It said $0 due. I thought it was a mistake. Turns out, I was already paid up through the installment plan, and I had saved money too. That’s when I realized—this isn’t just a trick for rookies. It’s a power move for seasoned investors too.

Final Thoughts

If you want to be a serious investor, landlord, or just a smart homeowner, it’s not just about how much money you make. It’s about how much you keep. And small strategies like these—installment plans, exemptions, timing—can put thousands back in your pocket over time.

So before you write your next tax check, take a breath… and take control.

Keep it consistent, stay patient, stay true—if I did it, so can you!

Ready to connect and strategize? Contact me at http://graystoneig.com/ceo –

Jorge Vazquez, CEO of Graystone Investment Group & Coach at Property Profit Academy

Pick your expert. Book your free 15-minute consult now. We are here to help!

Our Top Articles

“I’m No Crypto Expert, But…”: How I Turned Rent Money Into Bitcoin—and Why It Might Matter in Real Estate Now

Jorge Vazquez2025-07-17T02:10:56+00:00July 17th, 2025|Comments Off on “I’m No Crypto Expert, But…”: How I Turned Rent Money Into Bitcoin—and Why It Might Matter in Real Estate Now

“I’m No Crypto Expert, But…”: How I Turned Rent Money Into Bitcoin—and Why It Might Matter in Real Estate [...]

Your Rent Can Now Help You Buy a House

Jorge Vazquez2025-07-17T01:47:51+00:00July 17th, 2025|Comments Off on Your Rent Can Now Help You Buy a House

Your Rent Can Now Help You Buy a House (Yes, It’s Official) I was taking lunch while listening to [...]

Got a Call from the Tampa Bay Times Today… Let Me Tell You What Happened

Jorge Vazquez2025-07-17T01:47:24+00:00July 15th, 2025|Comments Off on Got a Call from the Tampa Bay Times Today… Let Me Tell You What Happened

Today was just a regular workday. I had some calls lined up, was checking in with [...]

Property Profit Academy:

✔ Learn to buy properties with little to no money down.

✔ Build a $10M portfolio step by step.

✔ Master strategies like BRRRR and house hacking.